From ancient Mesopotamia to the 21st century Chicago. The history of futures trading.

While nowadays Exchange Traded Futures are traded online, on modern and sophisticated platforms, the concept can be traced way back. The early references to the concept are evidence that humans have always been trying to find ways to improve the effectiveness of the way they make transactions and effectively, their lives.

Futures Trading in the ancient world

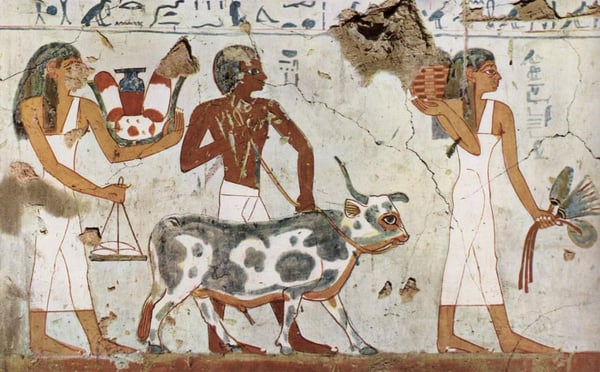

The first description of a concept not that different than Futures Trading as we know it today, dates to 1750 and was recorded on the Hamurambi code, one of the oldest deciphered writings in the world found in the area where ancient Mesopotamia used to be. Part of the code stated that goods must be delivered on an agreed-upon price at a date in the future given that a written contract has been issued. Back then, Futures Contracts were exchanged in ancient Mesopotamian temples.

References to early Futures Trading can be found in Aristotle’s writings where the story of Thales is described, a philosopher who made ‘agreements’ with olive mill owners to deposit his money with them and use their mills in the future, based on his prediction that harvest was going to be stronger.

The first ‘modern time’ Futures Exchange, the Dojima Rice Exchange’ was created in Osaka, Japan, back in 1697. There, speculators would gather and trade Futures Contracts on Rice, based on their perceived future value of rice. Why was Dojima Rice Exchange so important? Because Japanese leaders and Samurais were paid in rice.

Futures Trading in the modern world

The first type of modern Futures Trading which had the form of a forward agreement, began in the 1840s in Chicago due to its geographic location that connected the railroads through which midwestern producers and east coast populations used to meet and trade. After nearly 5 decades, the Board of Trade of the City of Chicago was formed, which was used as a meeting point for people to trade Forward Contracts.

It wasn’t long until the increased interest led the Board to standardize contract sizes as a way of simplifying procedures. This way, traders were called to trade Futures Contracts of the same quantity, quality, delivery months and terms – all set by the Exchange. These contracts could only be traded at the specific exchange and their bids, offers and negotiated prices were published by the exchange.

Standardized contacts became the norm because they only involved the renegotiation of the price. In other words, they were easy to trade. By the end of the 19th century, Futures Exchanges were all over the USA, with Chicago being the mecca of Futures Trading due to the establishment of the Chicago Mercantile Exchange (CME) which until this day, is considered to be the most influential and diverse location for Futures Trading.

The Futures Market evolves

Just like any other Financial Derivative product, Future Contracts are evolving based on trends and preferences. For example, while up until 1971 Futures Contracts were only available on Agricultural Commodities, Futures Exchanges started introducing contracts on Financial Products too. With money not being backed by gold anymore, Futures Exchanges were able to issue Futures Contracts on Currencies, whose value was now affected by Fundamentals and other factors.

At this time and age, Futures Traders can trade Futures Contracts on various asset classes including Stock Indices and even Interest Rates and Cryptocurrencies. One could say that nowadays, the Futures market is so vast, that traders of all kinds, despite risk tolerance or their preferred asset class, can enter the Futures Market. For example, while a Futures trader whose appetite for risk is quite high could trade a Futures Contract on Bitcoin, a more conservative trader, could pick a Futures Contract on a Commodity whose chart is traditionally not very volatile.

%20-%20MetaTrader%205%20-%20CME%20Micro%20Futures%20-%20Free%20Demo.png?width=346&name=AMP%20Global%20(Europe)%20-%20MetaTrader%205%20-%20CME%20Micro%20Futures%20-%20Free%20Demo.png)