Using win loss ratios from existing weekly day trading, can uncover a variety of insight as to critical modifications and changes. In this example we’ll look at six different price points during the trading day that if changed or managed would have doubled the profitability. Whether trading one day or a week, this amount of trades would have to question if there was over-trading involved, but that’s a topic for another day.

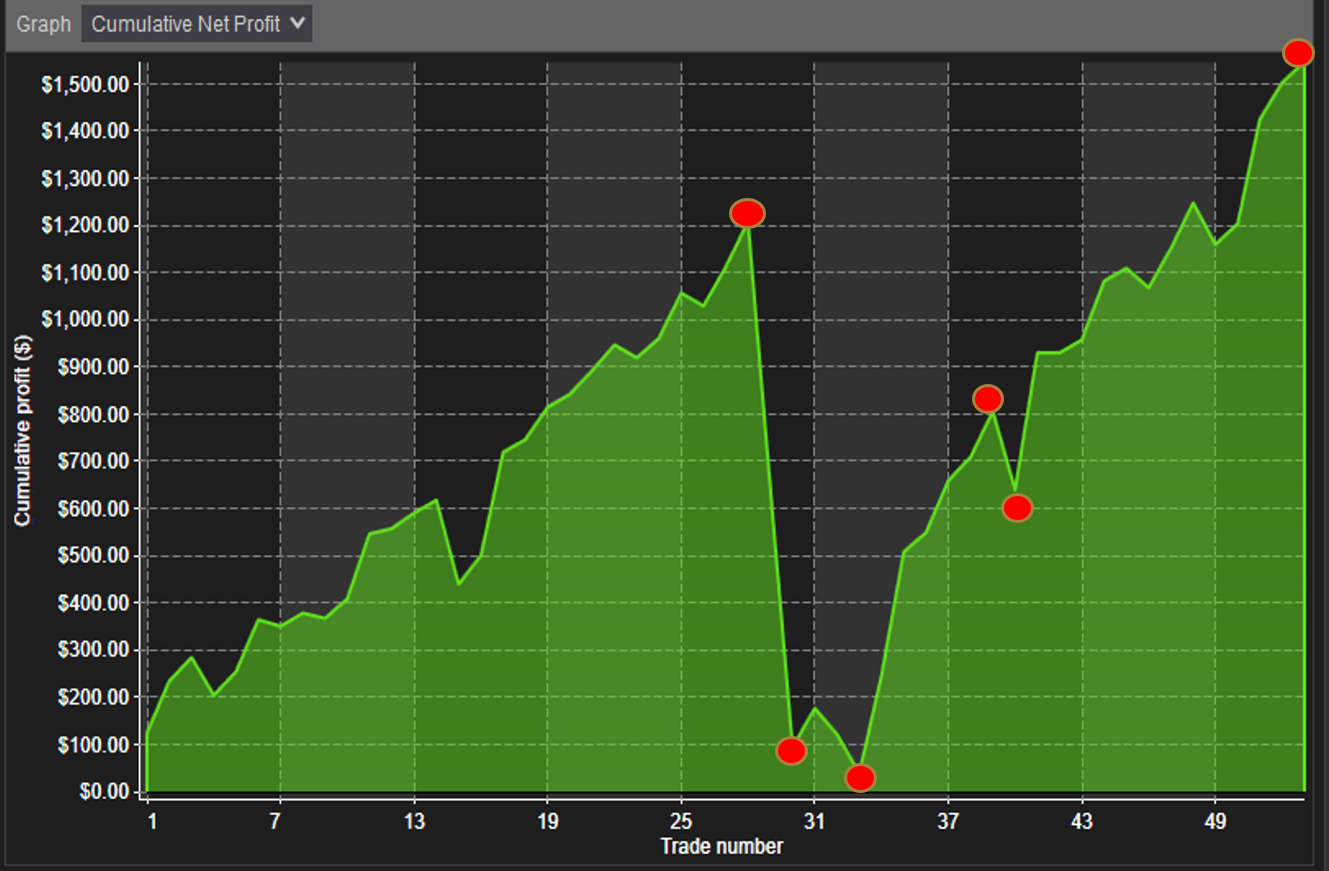

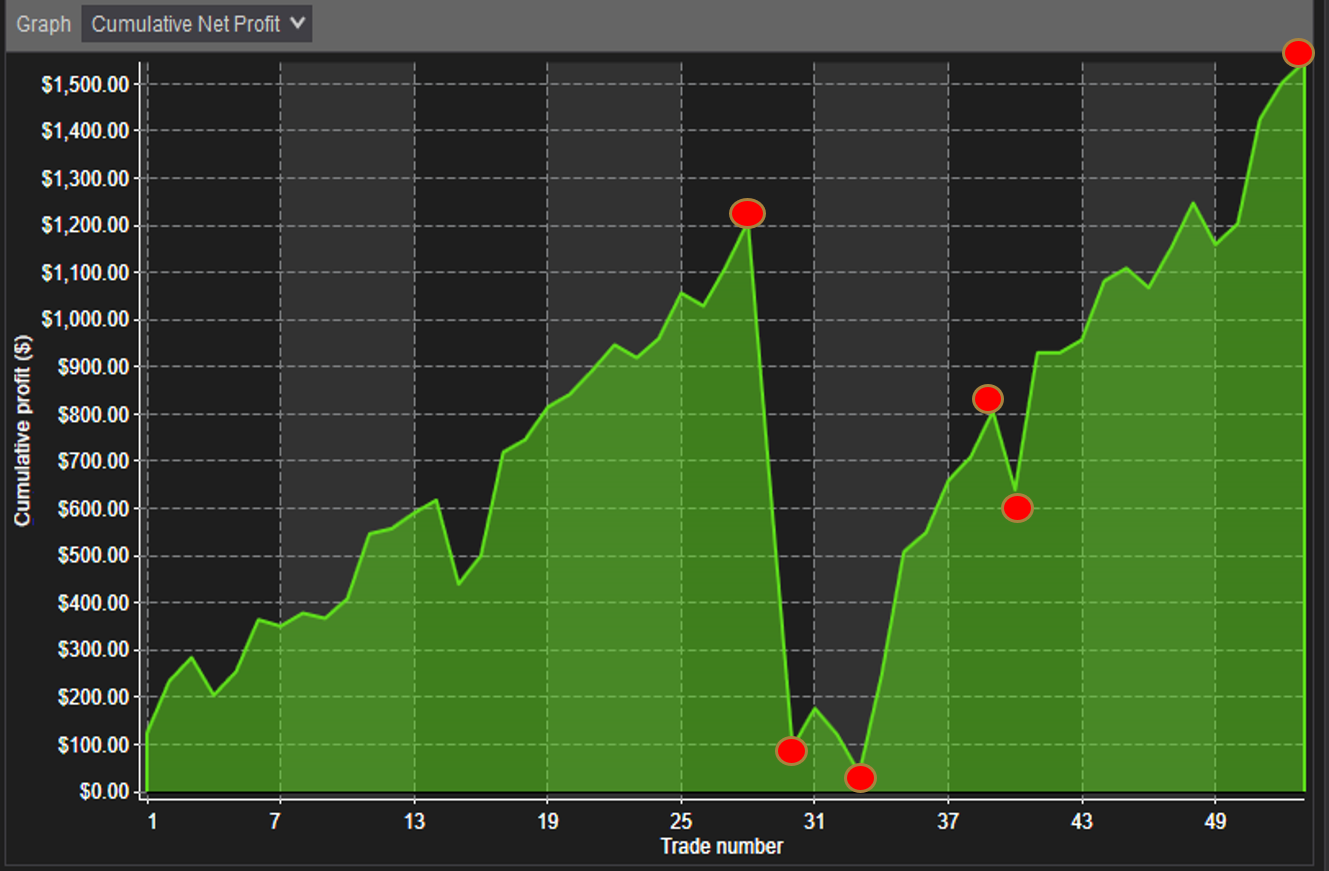

The example shows about 53 trades, and in this example, we’ll assume it’s one day. Our goal is to just look at the peaks and valleys of emotions generated from several trades price points.

The first level the trader achieved $1200 from about 27 trades. This is an example of an excellent run of winners with the biggest loser generating a $-200. This trader is in control of the trading day so far.

But this good stream of positive trades develops the momentum and builds-up of what I call, “Superman Syndrome” and overconfidence that they can’t lose. Self-talk translates into; “I can make more.” “I’m on a run.” “I’m in sync with the market.” A good run of winning trades stimulates an overconfident mindset that can translate into sloppy and risky trading. Holding onto a bad trade forces the trader to have to prove they’re RIGHT in the market is wrong. After all they’ve been right the whole morning. They may have moved stops or even canceled them watching their profitability slip away. There daily drawback rules for stopping in the day melted away. And once a trader commits to the loss, they even go into what I call the “I don’t care zone” and the exit is a blur until they get down to where they started. That’s the most dangerous part of Superman syndrome and very common. Once a trader’s confidence is shattered and reality hits now the challenge becomes recovery. At $50 profit he has to re-calibrate let go of the bad feelings plan each trade diligently or he should stop for the day. This change of mindset is challenging for the new trader and a caution for the experienced one.

Recovery is one of the three areas that high-end traders have learned to master. A plan and process needs to be in place to recover from a from a big loss or many losing trades. The three areas every trader must master come down to their emotions a well-defined set up and the ability to recover quickly from losses.

Here the trader hunkers down, gets disciplined, sets his targets and the first trade after the two losers gain him back $500. Next three winning trades bring them up to 800 and he’s almost back to where he started, again he could be feeling of “I’m back”. The next losing trade is at a -200 which seems to be his stop-loss rule that he had in the morning now he has to be very cautious not to extend a losing pattern but continue to stay disciplined focused and adhere to his drawback rules and tighten them up to reach back to the 1200.

He manages to do this in seven trades hitting the 1200+ and has worked very hard to get there. I Immediately after he hits the 1200 he has a losing trade. As a coach I may radar goes up and have to ask if this is an issue in the trading profitability at the $1200 mark? Each traders has a dollar threshold they can’t get through and in this case it appears to be $1200 . Hitting it twice immediately followed by in a losing trade.

He manages to break through that and with five more trades he crosses over the $1500 mark is exhausted from all the work that he’s done, and he finally stops for the day.

So what are the errors in his trading day looking at the bigger picture:

If he controlled and stuck to his $200 stop loss rules, he could have managed to gain 2500 for the day or more than double his profits.

- If he didn’t go into Superman Syndrome and have overconfidence after so many winning trades maybe he wouldn’t have held onto the bad trade as long as he did.

- Trying to prove being “right” can seriously cost you

- “Superman Syndrome” can be followed by the “I don’t care zone” and let trades slip away

What did he do well?

- After three trades, at the bottom of the P&L, he managed to control his emotions stay positive and make back three fourths of what he had lost, in winning trades.

- He managed to stick to his stop loss rules of $200 and recover from that one losing trade

- He reduced what he was willing to give back on future losses

- This was an excellent recovery process from the bottom to a new daily high

- He broke through his dollar threshold

So lessons learned from winning and losing:

- A trader needs to have very strict stop-loss rules to protect profits

- Traders need to be even MORE cautious when they have a winning run, not to fall prey to overconfidence and the Superman Syndrome

- Being honest and realistic is the first step of recovery, and to turn a losing pattern around

- Going slowly and steady wins the race with a good plan

- What are the emotions at the $1200. What areas need to be address?

- When should he stop for the day?

Hope you enjoyed and found value in this example. And for more information and free webinars visit: www.robindayne.com.

%20-%20MetaTrader%205%20-%20CME%20Micro%20Futures%20-%20Free%20Demo.png?width=346&name=AMP%20Global%20(Europe)%20-%20MetaTrader%205%20-%20CME%20Micro%20Futures%20-%20Free%20Demo.png)